Recent news signals regarding Meta Platforms indicate a surge in search interest for “meta stock.” Notably, the company recently reported strong Q4 earnings and revenue that beat Wall Street forecasts, prompting investors to reassess its market potential. This positive financial performance likely fueled curiosity and led to an increase in searches as stakeholders and potential investors sought further information about the stock’s prospects.

In contrast, news from other tech giants, such as Microsoft’s stock dropping due to concerns over slowing cloud growth, highlights a wider industry context that may enhance interest in more stable or promising stocks like Meta. Investors may be looking to pivot towards companies demonstrating strong earnings, thus further elevating search volumes for Meta.

Additionally, a prominent investor’s endorsement of Meta as “The Next Big Thing” signifies a growing bullish sentiment around the stock. Such endorsements often attract attention from both seasoned investors and market newcomers, creating heightened search activity as individuals investigate the reasons behind such optimism.

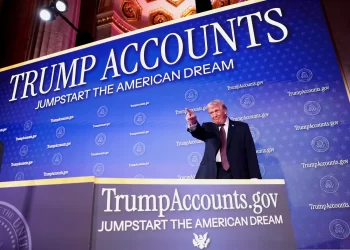

Watch the Moment

Internet Reacts

Additional Sources:

CNBC – Microsoft stock drops 7% on slowing cloud growth, light margin guidance

TipRanks – ‘The Next Big Thing,’ Says Top Investor About Meta Stock