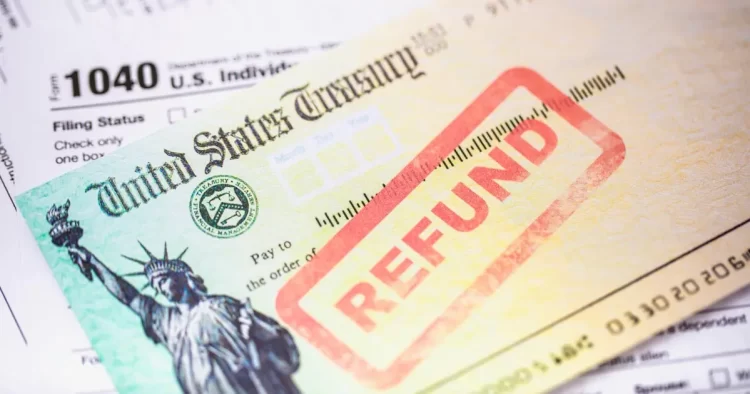

The recent increase in search interest for “new IRS tax deductions” can be attributed primarily to the introduction of a new $6,000 tax deduction for seniors, as reported by CBS News. This development is significant for Americans over 65, potentially impacting millions of taxpayers who may be looking to understand how to benefit from this financial opportunity. As seniors often experience fixed incomes, any new deductions can lead to substantial savings, prompting many to seek information on eligibility and application processes.

Additionally, the Tax Foundation’s coverage of tax refunds related to the “One Big Beautiful Bill Act” has drawn attention to changes in the tax landscape that could affect individual taxpayers. The discussions surrounding this legislation are likely causing individuals and families to explore the potential for new deductions and credits that may arise from such measures, further fueling search interest.

The expectation of revised tax brackets and rates for 2025-2026, highlighted by TurboTax, is contributing to heightened public curiosity about upcoming tax policies. As taxpayers start planning for future financial obligations, they are increasingly interested in understanding any new deductions that may become available, in order to optimize their tax situations and make informed financial decisions.

Watch the Moment

Internet Reacts

Additional Sources:

CBS News – How the new $6,000 senior tax deduction could affect millions of Americans over 65

Tax Foundation – Tax Refunds and the One Big Beautiful Bill Act